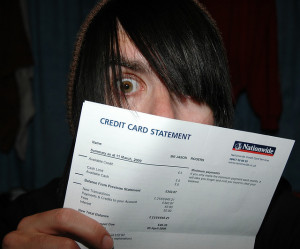

It will never happen! That must have been the thought in many people?s minds when they used their credit cards so liberally before the days of the recession. Somehow they did not regard the balances they were accumulating on one or multiple credit cards as any real problem. Even though each balance that was outstanding at the end of the month incurred a late fee they never really saw a day coming where they’d be free of the debt.

It will never happen! That must have been the thought in many people?s minds when they used their credit cards so liberally before the days of the recession. Somehow they did not regard the balances they were accumulating on one or multiple credit cards as any real problem. Even though each balance that was outstanding at the end of the month incurred a late fee they never really saw a day coming where they’d be free of the debt.

The recession blew way the general feeling of complacency and reality struck. Many were simply unable to meet their obligations and the consequences have been various. One consequence that has been constant is their owners? credit score has plummeted and as a result their ability to borrow today has been diminished.

Convenience but…

No one disputes that credit cards are the most convenient way to buy these days but they must be used properly. They provide interest free credit only if the outstanding balances are paid in full each month. Credit cards that have been used to finance everyday living when someone is living beyond their means become extremely dangerous and dig their user a bigger hole.

The problem never goes way without some kind of action by the borrower. With the average credit card debt hovering around $15,000 per household, it can make it feel impossible to ever be free from the shackles.

Consolidation

In some instances a consolidation loan with realistic loans might be the answer to getting some relief. Such a loan allows individuals to have one payment, as opposed to multiple ones, along with a lower overall interest rate.?Doing this in connection with avoiding credit cards altogether can help you get out of debt quicker while also saving some money along the way.

Everyone wanting to clear the cards slowly should start to think about throwing any extra money they have at killing the debt.?You can earn extra money through a side hustle, or you can even send in payments throughout the month to knock down the balance even more.

Feel Good

Psychologically it may be a good move for those with several cards to get rid of them one by one starting with the one with the smallest balance. That way there will be the quickest sign of a result and is known as the debt snowball approach. If the minimum payment is paid on the other cards you can then focus all your effort on the smallest balance. Once you pay off that first card then you can begin to focus on the other cards to pay them off. Alternatively the first card to target is the one which is incurring the highest interest. This is the logical approach as opposed to the emotional one that needs to see a quick result by tackling the smallest balance.

The only way that anyone will pay off overwhelming debt is to find the self-discipline required to stop spending and not being enslaved to poor money decisions. It might feel impossible to kill your debt, but it is most certainly possible – you just need to want it and be willing to make the sacrifices needed to live a life of prudence.

Photo courtesy of: Jason Rogers

Wise Dollar

Latest posts by Wise Dollar (see all)

- 8 Investing Tips That All Beginners Should Know About - May 11, 2021

- 5 Reasons Why Freelancing Should Be Your Next Career Move - March 9, 2021

- 5 Ways to Improve Your Sales Pitch and Get Funding - February 22, 2021

Leave a Reply